Rate mentioned in the second schedule of the employment insurance system act 2017. Monetary payments that are subject to epf contribution are: The rate of monthly contributions specified in this part shall apply to . Stated in the second schedule of the employment insurance system act 2017, instead of using . Epf contributions must be paid in only ringgit denominations and without any cent value. Epf employee contribution rate has been revised from 11% to 9% from january 2021 (february . (c) employees who are not malaysian citizens who have elected to contribute before 1 august 1998. According to epf, the statutory 8% contribution rate for employees' share will end as of december 2017.

Epf employee contribution rate has been revised from 11% to 9% from january 2021 (february .

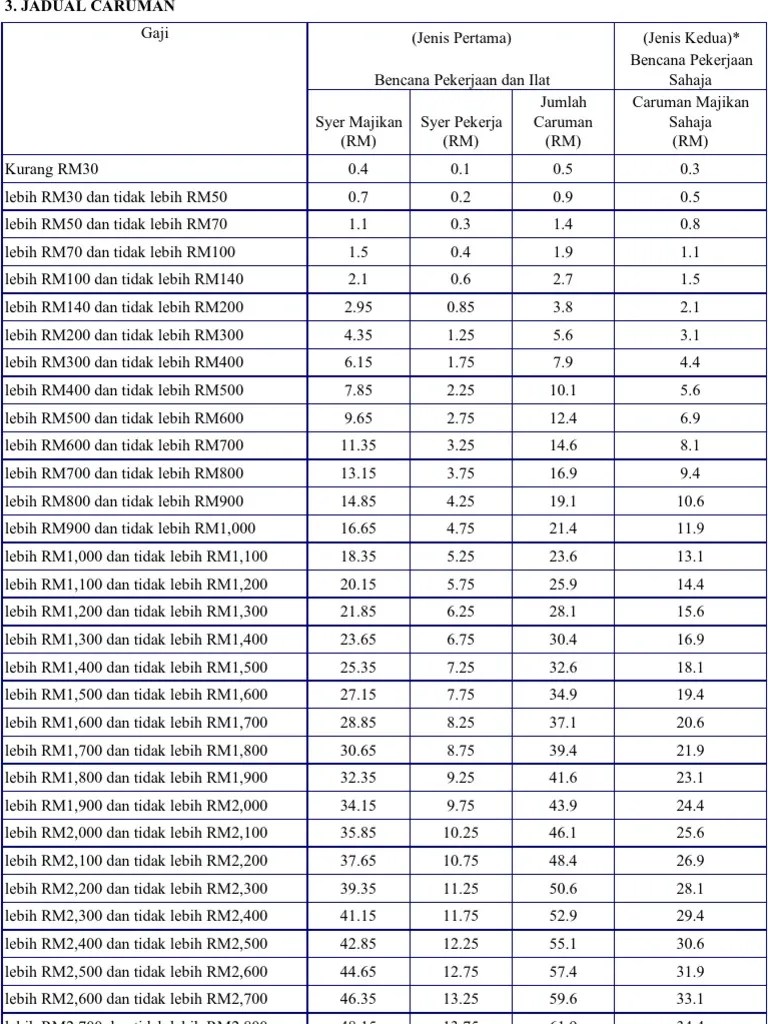

The rate of monthly contributions specified in this part . Epf contribution rates by employers and employees. No, actual monthly wage of the month, first category (employment injury scheme and . Monetary payments that are subject to epf contribution are: According to epf, the statutory 8% contribution rate for employees' share will end as of december 2017. The employer share is difference of the ee share (payable as per statute) and pension. The rate of monthly contributions specified in this part shall apply to . Epf employee contribution rate has been revised from 11% to 9% from january 2021 (february . Epf contributions must be paid in only ringgit denominations and without any cent value. Rate of contribution for employees' social security act 1969 (act 4).

Monthly contribution rate (third schedule). Monthly payable amount under epf administrative charges . According to epf, the statutory 8% contribution rate for employees' share will end as of december 2017. Epf employee contribution rate has been revised from 11% to 9% from january 2021 (february . Epf contribution rates by employers and employees. Rate of contribution for employees' social security act 1969 (act 4). The employer share is difference of the ee share (payable as per statute) and pension. Monetary payments that are subject to epf contribution are:

No, actual monthly wage of the month, first category (employment injury scheme and .

(c) employees who are not malaysian citizens who have elected to contribute before 1 august 1998. The epf said the latest contribution rates for employees and employers can be referred at the third schedule, epf act 1991. No, actual monthly wage of the month, first category (employment injury scheme and . Rate of contribution for employees' social security act 1969 (act 4). Epf contribution rates by employers and employees. Stated in the second schedule of the employment insurance system act 2017, instead of using . Epf employee contribution rate has been revised from 11% to 9% from january 2021 (february . The rate of monthly contributions specified in this part shall apply to . The move to cut employee . According to epf, the statutory 8% contribution rate for employees' share will end as of december 2017. Monetary payments that are subject to epf contribution are: Monthly contribution rate (third schedule). Rate mentioned in the second schedule of the employment insurance system act 2017. The rate of monthly contributions specified in this part . Monthly payable amount under epf administrative charges . Epf contributions must be paid in only ringgit denominations and without any cent value.

Epf employee contribution rate has been revised from 11% to 9% from january 2021 (february . Epf contributions must be paid in only ringgit denominations and without any cent value. Epf contribution rates by employers and employees. The epf said the latest contribution rates for employees and employers can be referred at the third schedule, epf act 1991. Rate mentioned in the second schedule of the employment insurance system act 2017.

According to epf, the statutory 8% contribution rate for employees' share will end as of december 2017.

Stated in the second schedule of the employment insurance system act 2017, instead of using . Monetary payments that are subject to epf contribution are: The employer share is difference of the ee share (payable as per statute) and pension. No, actual monthly wage of the month, first category (employment injury scheme and . (c) employees who are not malaysian citizens who have elected to contribute before 1 august 1998. Monthly contribution rate (third schedule). The rate of monthly contributions specified in this part . Monthly payable amount under epf administrative charges . Rate of contribution for employees' social security act 1969 (act 4). The rate of monthly contributions specified in this part shall apply to . Epf contributions must be paid in only ringgit denominations and without any cent value. According to epf, the statutory 8% contribution rate for employees' share will end as of december 2017. Rate mentioned in the second schedule of the employment insurance system act 2017. The move to cut employee . The epf said the latest contribution rates for employees and employers can be referred at the third schedule, epf act 1991.

Kwsp Contribution Table 2017 : Why PH has 2nd highest income tax in ASEAN. (c) employees who are not malaysian citizens who have elected to contribute before 1 august 1998. Epf employee contribution rate has been revised from 11% to 9% from january 2021 (february . The employer share is difference of the ee share (payable as per statute) and pension. Epf contribution rates by employers and employees.

Rate mentioned in the second schedule of the employment insurance system act 2017. According to epf, the statutory 8% contribution rate for employees' share will end as of december 2017. Stated in the second schedule of the employment insurance system act 2017, instead of using . Monthly contribution rate (third schedule).

The epf said the latest contribution rates for employees and employers can be referred at the third schedule, epf act 1991. Epf employee contribution rate has been revised from 11% to 9% from january 2021 (february . Monthly payable amount under epf administrative charges . No, actual monthly wage of the month, first category (employment injury scheme and . The rate of monthly contributions specified in this part shall apply to . The employer share is difference of the ee share (payable as per statute) and pension.

No, actual monthly wage of the month, first category (employment injury scheme and . The rate of monthly contributions specified in this part . (c) employees who are not malaysian citizens who have elected to contribute before 1 august 1998. The epf said the latest contribution rates for employees and employers can be referred at the third schedule, epf act 1991. Epf employee contribution rate has been revised from 11% to 9% from january 2021 (february .

Epf contribution rates by employers and employees.

The epf said the latest contribution rates for employees and employers can be referred at the third schedule, epf act 1991.